Gaining a deep understanding of the Daneric Elliott Wave theory is crucial for traders and investors aiming to refine their market analysis skills. This innovative adaptation of the classic Elliott Wave Theory offers a fresh perspective on market behavior and trends. By mastering this technique, traders can make more informed decisions and significantly improve their trading strategies.

The financial markets represent a highly intricate ecosystem that demands a profound comprehension of recurring patterns and trends. The Daneric Elliott Wave, developed by Daneric, builds upon the pioneering work of Ralph Nelson Elliott, offering traders a robust tool to identify market cycles and forecast future price movements. This method has garnered popularity among both seasoned professionals and novices, making it an essential component of modern trading practices.

In this comprehensive article, we delve into the foundational principles of the Daneric Elliott Wave theory, its practical applications, and how it can elevate your trading abilities. By the conclusion of this guide, you will possess a thorough understanding of this cutting-edge approach and how to seamlessly integrate it into your trading strategy.

Read also:Marie Osmond Shares Heartwarming Family Moment Amid Las Vegas Show Closure

Table of Contents

- Exploring the Daneric Elliott Wave

- Origins of the Elliott Wave Theory

- Who is Daneric?

- Core Principles of Daneric Elliott Wave

- Key Patterns in Elliott Wave Analysis

- Implementing Daneric Elliott Wave in Trading

- Benefits of Using Daneric Elliott Wave

- Addressing Challenges and Limitations

- Essential Tools for Daneric Elliott Wave

- The Future of Daneric Elliott Wave

- Summary and Call to Action

Exploring the Daneric Elliott Wave

The Daneric Elliott Wave theory represents an advanced interpretation of the original Elliott Wave Theory, which was formulated in the 1930s by Ralph Nelson Elliott. This modern adaptation provides traders with a more precise and sophisticated method of analyzing market trends and cycles. By thoroughly understanding the underlying principles of the Daneric Elliott Wave, traders can gain invaluable insights into market behavior, thereby enhancing their decision-making processes.

Recognizing Market Cycles

The Daneric Elliott Wave places significant emphasis on the identification of market cycles, which are recurring patterns that manifest in financial markets. These cycles can be categorized into two primary phases: impulse waves and corrective waves. Impulse waves progress in the direction of the broader trend, while corrective waves move against it. The ability to discern these phases is pivotal for achieving trading success.

Applications Across Financial Markets

A notable advantage of the Daneric Elliott Wave is its adaptability. This theory can be effectively applied to various financial markets, including stocks, forex, commodities, and even cryptocurrencies. Irrespective of the market, the fundamental principles of the Daneric Elliott Wave remain consistent, rendering it an indispensable tool for traders operating in diverse asset classes.

Origins of the Elliott Wave Theory

The Elliott Wave Theory was initially introduced in the 1930s by Ralph Nelson Elliott, a professional accountant who meticulously observed repetitive patterns within the stock market. Elliott's groundbreaking research laid the groundwork for modern technical analysis and has been widely embraced by traders and analysts across the globe.

Key Contributions of Ralph Nelson Elliott

- Identified consistent and repetitive patterns in financial markets.

- Developed the foundational concepts of impulse and corrective waves.

- Introduced the innovative concept of fractals in market analysis.

Evolution of the Theory

Over the decades, the Elliott Wave Theory has undergone significant evolution, with numerous experts contributing to its development. Daneric's adaptation of the theory incorporates contemporary market dynamics and technological advancements, making it more accessible and practical for today's traders.

Who is Daneric?

Daneric is a highly respected trader and analyst who has made substantial contributions to the field of technical analysis. With extensive experience in financial markets, Daneric has devised a unique approach to the Elliott Wave Theory, earning widespread recognition and acclaim within the trading community.

Read also:Kate Hudsons Coparenting Success Story Love Communication And Teamwork

Biographical Information

| Full Name | Daneric |

|---|---|

| Occupation | Trader, Analyst, Educator |

| Area of Expertise | Elliott Wave Theory, Technical Analysis |

| Notable Contributions | Pioneering the Daneric Elliott Wave Theory |

Core Principles of Daneric Elliott Wave

The Daneric Elliott Wave theory is grounded in several fundamental principles that guide traders in analyzing market trends and patterns. These principles encompass the concepts of impulse waves, corrective waves, and fractals, all of which are essential for comprehending market behavior.

Impulse Waves

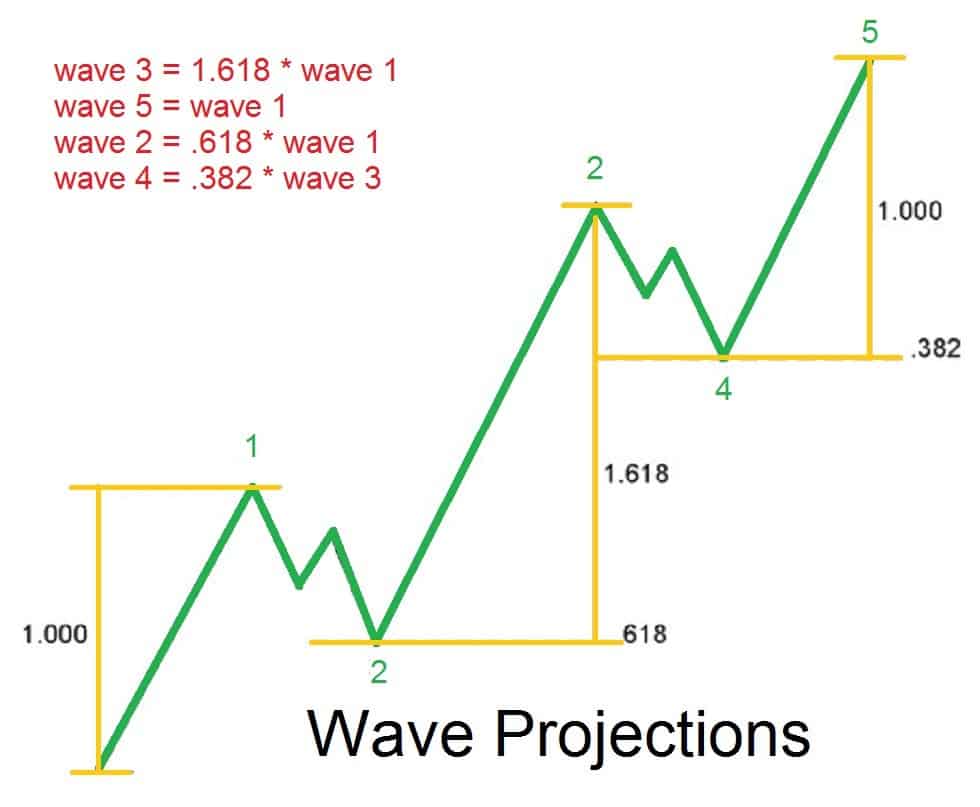

Impulse waves serve as the driving forces behind market trends, advancing in the direction of the larger trend. These waves consist of five distinct sub-waves, each characterized by its unique attributes and patterns. The recognition of impulse waves is critical for pinpointing potential trading opportunities.

Corrective Waves

Contrarily, corrective waves move against the larger trend and are generally more intricate than impulse waves. These waves can assume various forms, such as zigzags, flats, and triangles. Understanding corrective waves is vital for managing risk and refining trading strategies.

Key Patterns in Elliott Wave Analysis

Daneric Elliott Wave analysis entails the identification of key patterns within market data. These patterns offer traders profound insights into market behavior and assist in predicting future price movements.

Impulse Wave Patterns

- Wave 1: Marks the initial upward movement.

- Wave 2: Represents the correction of Wave 1.

- Wave 3: Identified as the strongest and longest wave.

- Wave 4: Acts as the correction of Wave 3.

- Wave 5: Concludes with the final upward movement.

Corrective Wave Patterns

- Zigzag: Characterized by a three-wave corrective structure.

- Flat: Exhibits a horizontal corrective pattern.

- Triangle: Features a converging corrective pattern.

Implementing Daneric Elliott Wave in Trading

Traders can effectively apply the Daneric Elliott Wave theory to their trading strategies by adhering to a systematic and structured approach. This involves analyzing market trends, identifying key patterns, and utilizing this information to make well-informed trading decisions.

Step-by-Step Guide

- Examine market data meticulously to identify prevailing trends.

- Accurately recognize impulse and corrective waves within the market.

- Apply identified patterns to predict forthcoming price movements.

- Adjust and refine trading strategies based on comprehensive analysis.

Benefits of Using Daneric Elliott Wave

Utilizing the Daneric Elliott Wave theory in trading offers numerous advantages, including:

- An enhanced comprehension of market behavior and dynamics.

- An improved capability to identify lucrative trading opportunities.

- Increased confidence in executing informed and strategic decisions.

- Flexibility and adaptability across diverse financial markets.

Addressing Challenges and Limitations

Although the Daneric Elliott Wave theory presents many advantages, it is not devoid of challenges. Traders must remain cognizant of its limitations and devise strategies to overcome potential hurdles.

Common Challenges

- Interpreting and deciphering complex wave patterns.

- Managing market noise and volatility effectively.

- Adapting strategies to the ever-changing market conditions.

Essential Tools for Daneric Elliott Wave

Several tools are available to assist traders in implementing the Daneric Elliott Wave theory with precision and efficiency. These include advanced charting software, specialized indicators, and comprehensive educational resources.

Recommended Tools

- TradingView: A widely acclaimed platform for charting and analysis.

- MetaTrader: A versatile trading platform equipped with built-in indicators.

- Online courses and tutorials: Providing in-depth learning opportunities.

The Future of Daneric Elliott Wave

As financial markets continue to evolve and transform, the Daneric Elliott Wave theory is poised to assume a more prominent role in trading and analysis. Technological advancements and sophisticated data analysis techniques will further enhance the capabilities of this approach, solidifying its position as an indispensable tool for traders in the future.

Summary and Call to Action

In conclusion, the Daneric Elliott Wave theory equips traders with a powerful instrument for analyzing market trends and patterns. By thoroughly comprehending the principles of this approach and applying them methodically, traders can elevate their decision-making processes and refine their trading strategies.

We encourage you to share your thoughts, experiences, and insights regarding the Daneric Elliott Wave in the comments section below. Furthermore, feel free to explore other informative articles on our website for additional perspectives on trading and financial markets.

Sources:

- Elliott, R. N. (1938). The Wave Principle.

- Daneric. (n.d.). Daneric Elliott Wave Theory.

- Investopedia. (2023). Elliott Wave Theory.